Analyzing the Post-Pandemic Economy and the Impact of Rising Global Energy Prices

Executive Summary

The report examines the economic indicators of the inflation rate, unemployment rate, and real GDM (Gross Domestic Product) in the context of the COVID-19 pandemic. It highlights how the pandemic has significantly impacted these indicators, resulting in unprecedented levels of economic disruption and job losses. Policymakers should be concerned about unemployment, inflation, and the economy’s growth as they are key indicators of a country’s economic health, affecting the well-being of citizens, businesses, and overall socio-economic development.

The effects of increasing global energy costs on the economy in the aftermath of the epidemic are also analyzed in this research. It discusses how energy prices are a key determinant of inflation and how the recent increases could lead to a further rise in inflation, thus affecting the overall economic recovery. It also discusses how recent energy price increases could lead to a further rise in inflation.

The problems created by the post-pandemic economy and increasing energy costs are addressed in the paper, which includes suggestions for politicians and companies to solve these issues. It highlights the necessity of a coordinated effort to invest in renewable energy sources and infrastructure to reduce reliance on fossil fuels, as well as targeted policies to support job creation and economic growth. This is in addition to the fact that it emphasizes the importance of reducing reliance on fossil fuels.

Business cycle

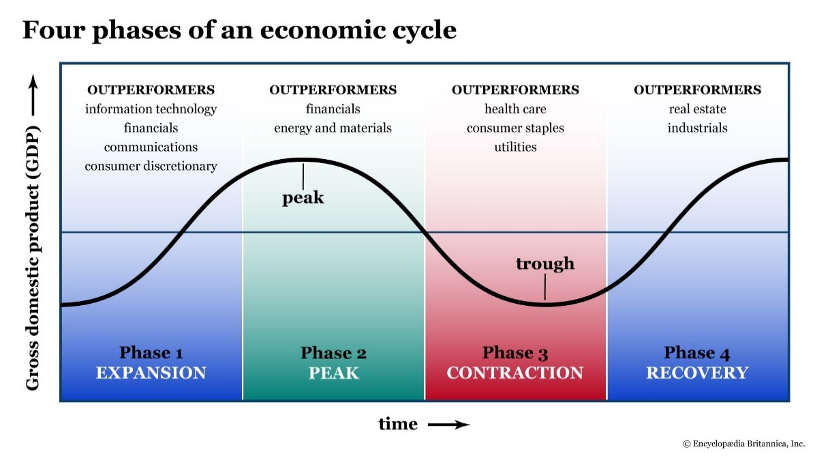

The business cycle describes the recurring pattern of economic expansion and contraction activities over time, characterized by fluctuations in real GDP, employment, inflation and other macroeconomic indicators. The cycle’s four phases are expansion, peak, contraction(recession) and recovery.

During the expansion phase, the economy grows, and economic indicators such as Gross Domestic Product (GDP), employment and consumer spending rise. The phase is often related to increased business investment and consumer confidence (Baldwin & Di Mauro, 2020 ). The peak phase marks the end of the expansion phase and is characterized by the highest economic growth point before the economy slows down.

The third phase is the contraction or recession phase, where the economy starts to slow down, and economic indicators begin to decrease. The phase is associated with increased unemployment and a decrease in consumer spending businesses reach the trough, the lowest point of economic growth before the economy starts recovering (Mitchell, W. C. (2022). The recovery phase is when the economy emerges from the recession or contraction phase towards expansion. During recovery, there is an increase in economic activity, including rising levels of unemployment, production and consumer spending. The economic indicator that tracks the business cycle phases is Gross Domestic Product (GDP).

The following diagram illustrates the phases of the business cycle:

The graph shows Gross Domestic Product on the vertical axis and time on the horizontal axis. The line graph shows the fluctuations in GDP over time. An upward slope characterizes the GDP time expansion phase, the GDP line’s highest point; the contraction phase by a downward slope, and the recovery phase by an upward slope marks the peak phase.

Following the macroeconomic theory, during the expansion phase, unemployment tends to decline as businesses increase hiring to meet the rising demands. Inflation starts arising as demand increases, and suppliers start facing capacity constraints. During the peak stage, unemployment increases as businesses cut back on hiring and production. Inflation may also start to spike as capacity constraints become more binding. During the contraction phase, unemployment rises sharply as enterprises cut back on production and employment. Inflation starts slowing down as demand declines. Finally, unemployment remains high in the recovery phase, but inflation may increase again as companies and businesses begin to ramp up production in response to increased demand.

Real GDP growth rate

Real Gross Domestic Product (GDP) is a macroeconomic measure of the value of all goods and services produces a macroeconomic scale of the value of all goods and services produced in a country, adjusted for inflation. GDP reflects a country’s economic output, and changes in its growth rate indicate the economy’s health (Bekaert et al.,2020). Real Gross Domestic Product is calculated using a formula that adjusts the nominal GDP for chang